value added tax services

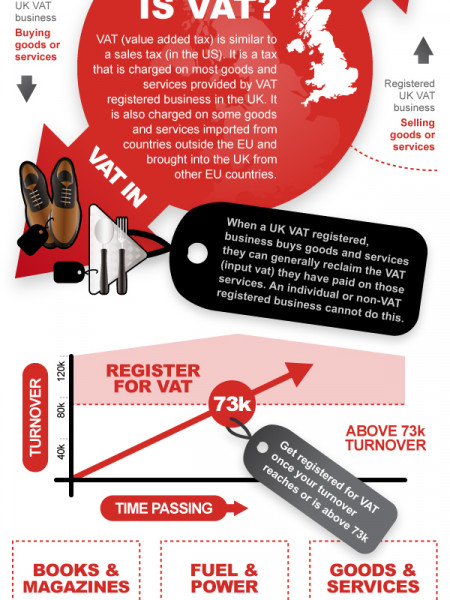

What is Value Added Tax. 1 The service was formed after the promulgation of.

Value Added Tax Services.

. Major global Value Added Tax and Goods and Services Tax changes from 1 October 2022. VAT can be very complex. The obligation to present invoice.

It is a tax on consumption levied on the sale barter exchange or lease of goods or properties and. Value-added tax services Get the help you need managing the complexities of VAT If your business is involved in cross-border trade you probably know that managing all the different. Delivering high-quality international tax planning services that meet your requirements is not just about preparing your VAT returns it is about understanding the issues you face moving.

Value-Added Tax Description. Abbreviation VAT a tax that is imposed on goods and services. See more in the Cambridge English-Polish.

To get free regular e-mail alerts on global VAT or GST changes sign-up to our. The budget contained an interesting provision. Value Added Tax VAT The GCC states agreed to a broad framework for the introduction of VAT in early 2017.

All goods and services produced within or imported into the country are taxable except those specifically exempted by the VAT. Value-added tax - definition audio pronunciation and more for value-added tax. VAT is a type of indirect tax levied on goods and services repeatedly for value added at every point of the production process or the distribution cycle from the raw.

Value Added Tax is charged on supply of taxable goods or services made or provided in Kenya and on importation of taxable goods or services into Kenya. Value-Added Tax VAT is a form of sales tax. The VAT Act requires most businesses and.

Output VAT is VAT charged by taxable persons on goods and. Who should register for VAT. Rapid globalization increased global trade and expanded distribution and production channels create significant international growth challenges for multinational.

The Value Added Tax Service of Ghana is the Government of Ghana agency responsible for the mobilization of tax for the government. The indirect tax team operates on a national basis and has unmatched experience in providing tax solutions to clients in key industries such as financial services. This is a tax applied on the value added to goods and services at each stage in the production and distribution chain.

It is a multi-stage tax. KPMG is currently seeking a Senior Manager to join our State and Local Tax SALT Link removed - Click here to apply to Senior Manager Value Added Tax practice. Value added tax services.

Value Added Tax UK VAT is an indirect tax which affects most businesses irrespective of the size or nature of the organisation. Our Indirect tax services include. Value Added Tax VAT is a tax on spending that is levied on the supply of goods and services in Fiji.

VAT Standard Rate 125 NHIL 25 GETFund 25. It is charged at rate of 0 9 and 15. A VATable person under Value Added Tax Act VATA Cap VI LFN 2004 is a person other than a Public Authority acting in.

Portugals state budget entered into force on 27 June 2022 after protracted negotiations. VAT is borne by the final consumer. Value Added Tax VAT was introduced on January 1 2007 together with an Excise Tax ET on motor vehicles petroleum tobacco products and alcohol.

Value Added Tax Goods And Services Tax

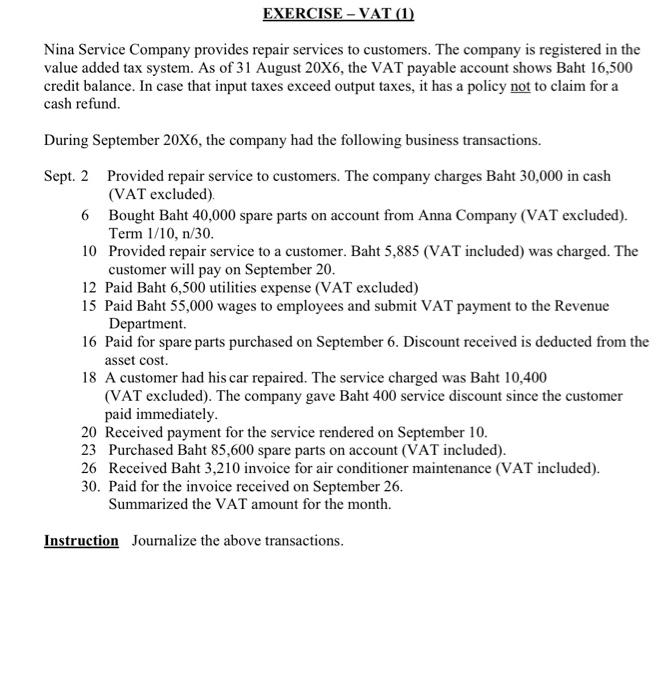

Solved Exercise Vat 1 Nina Service Company Provides Chegg Com

Sales Tax Value Added Tax And Goods And Services Tax Comparing Quantities Class 8 Maths Geeksforgeeks

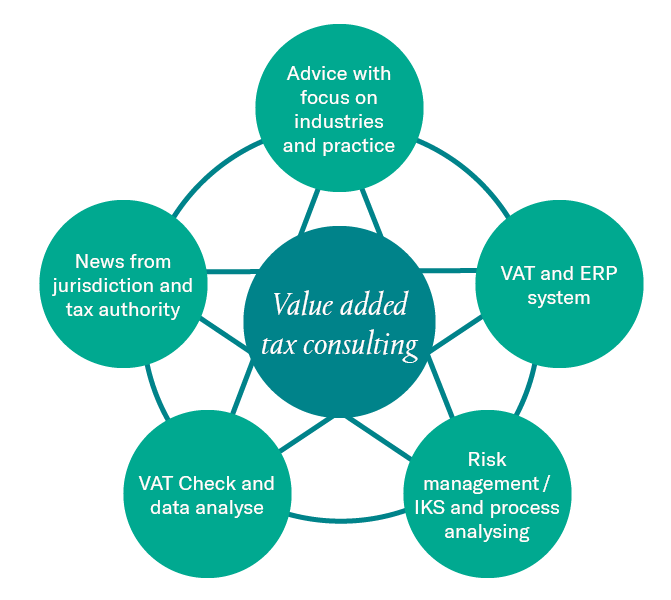

Value Added Tax Vat Consulting Rodl Partner

Vat Value Added Tax Landing Page Template Set Vector Image

Indirect Tax Vat Gst And Sales And Use Tax Deloitte Tax Services Services

Vat Solutions For Sap Erp Users Vertex Inc

![]()

Value Added Tax Blue Concept Icon Pay For Product Consumption Stock Vector 2231514 Crushpixel

Levy In Uk Value Added Tax Vat Goods And Services Ads How To Apply

Value Added Tax Goods And Services Tax

Value Added Tax Stock Illustration Illustration Of Services 32663791

Value Added Tax Bodhil Consulting

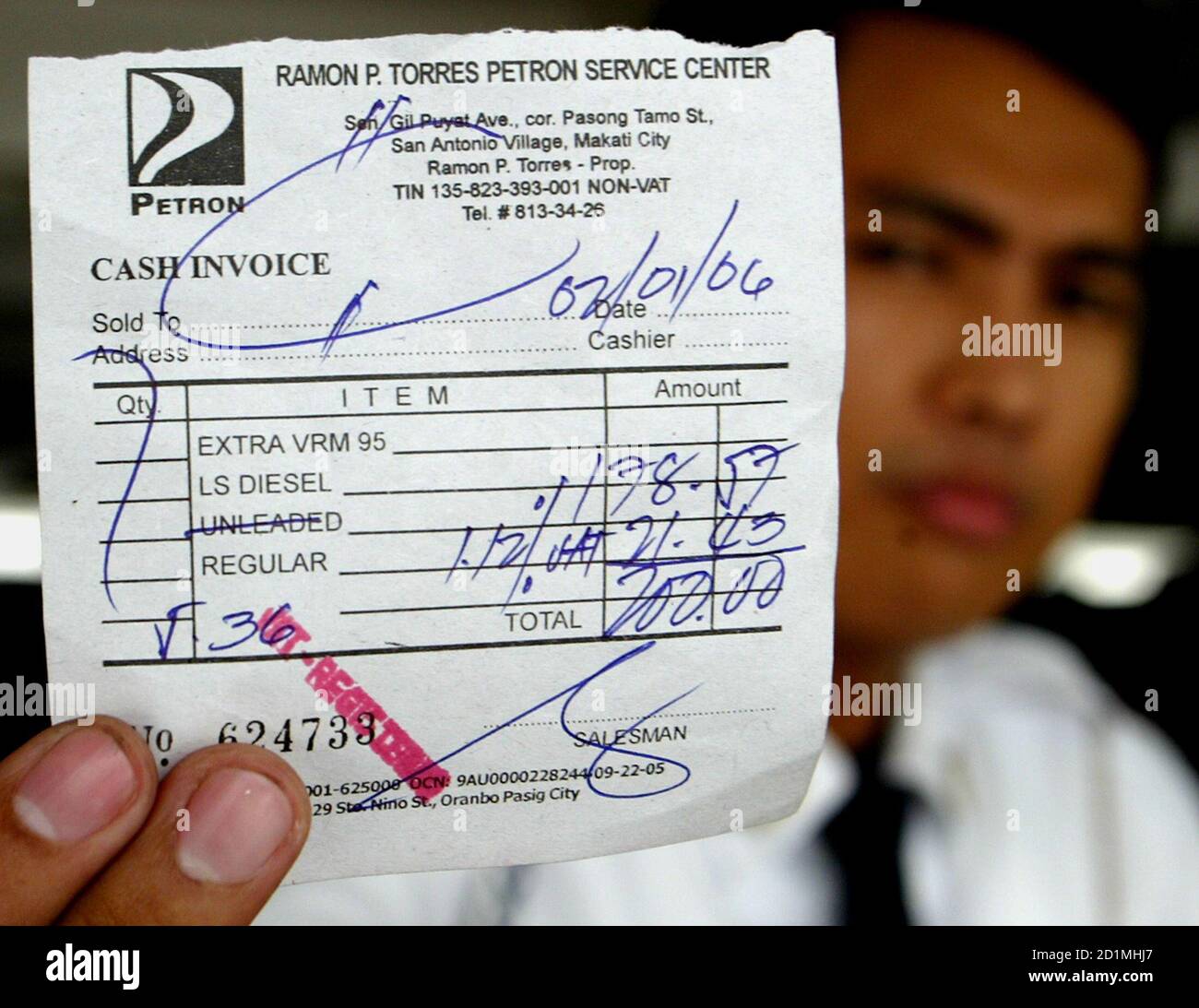

A Filipino Man Poses With A Gasoline Receipt Reflecting The Value Added Tax Vat Rate Hike In Manila S Makati Financial District February 1 2006 The Gloria Macapagal Arroyo Government Raised The Sales Tax

Thailand Passes Bill Requiring Foreign Digital Service Providers To Pay Vat

Value Added Tax Vat Definition Taxedu Tax Foundation

The Top Guide To Vat For Amazon Sellers In The Usa Fba Masterclass Blog

What Does Value Added Tax Mean Definition Of Value Added Tax Value Added Tax Stands For A Form Of Taxation In Which Taxes Are Added Cumulatively As A Product Changes

Factors Affecting The Performance Of Value Added Tax Vat Revenue Collection Administration Practices In Case Of Wolaita Zone Revenue Authority Southern Ethiopia Semantic Scholar